The world is on the cusp of an epochal transformation in digital financial services. Open Banking Technology is replete with potential business models as social media were 15 years ago and e-commerce 20 years ago.

Open Banking, fuelled by regulatory, technology, and competitive dynamics, brings hyper-relevant data and platform-based distribution networks to the fold of fintech companies. This helps them deliver a seamless and engaging digital experience that customers are eagerly looking for.

One of the most challenging aspects of Open Banking is the security and compliance concerns. Hence, sharing data only with the consent of the customers (i.e., regulated access) is at the heart of Open Banking Services. However, it is interesting to note, that a study revealed – 60% of Americans choose fintech over privacy!

Let us start by understanding the need for this disruption in the financial services sector called – Open Banking

We are in an era where immediate access to credit card payments, bill payments, mobile recharges, direct debit control, mortgage comparisons and lending, and so much more is achieved with a mere swipe on a smartphone! These apps are powered by financial data available with banks and evolve with the changing need of the hour.

Fintech startups and firms are one of the major drivers of such changes. The sole aim of any startup is to create new products and services that solve a consumer problem and distinguish themselves from their competitors. And why should financial services startups be any different?

Banks are traditionally known to offer services with higher operational costs and complexities. Today, customers look forward to personalized solutions, even in the banking domain. However, the risk-averseness of banks and tech-driven tools aimed at offering hyper-personalized financial solutions by Fintechs have opened the doors for Open Banking Technology worldwide.

Thus, Open Banking System is the process of banks and other financial institutions making data available for regulated service providers to access, use, and share via Application Programming Interfaces (APIs).

Open Banking facilitates the networking of accounts and data across institutions for use by consumers, financial institutions, and Third-Party Service Providers (TPPs). It allows new companies and new products to penetrate the market, by using this data in helpful, and innovative ways.

Application Modernization for ISO 20022 adoption

Listed below are a few of the reasons why Fintechs and Open Banking have become indispensable to end-customers:

- Greater focus on customer experience over simply offering traditional banking services

- Ever-growing influence of the internet and smartphones that call for innovative mobile apps

- Completely online end-to-end cashflow

- Financial solutions that drastically reduce the turnaround time between two processes as opposed to the conventional operational delays.

- Comprehensive solutions that bring together diverse applications on a unified platform

Why must Fintechs collaborate with Banks to harness the true potential of the Open Banking System?

In the $400+ billion Open Data Economy, fintechs can influence the entire financial value chain beyond payments and retail banking. They have the technology, strategy, and resources to develop apps and innovative solutions that enhance user experience.

Fintechs aspire to be the one-stop solution to all the banking-related activities of customers (B2B and B2C). However, the requirements for such a transition are uneconomical and time-consuming. Thus, taking away from the core business aspects like technology and innovation.

To leverage the end-benefits of Open Banking Technology, fintechs must partner with traditional banks to facilitate:

Access to Funds

As banks are THE source of money

Access to Data

To monetize internal customer data from banks by channeling into the development of useful financial solutions.

Regulatory Compliance

To ensure compliance with established guidelines that protect customer data

Consumer Confidence

To leverage the inherent consumer loyalty to banks

To process payments

By developing user-centric apps that employ established bank cards like debit cards for transactions.

Open Banking Platform – A Global Perspective

In many nations, Open Banking is finding many takers. In the European Union, the Payment Services Directive, or PSD2, has jump-started growth from small business lending to new payment options like cryptocurrency to more lucrative savings accounts. In fact, customers in the largest trade block are loving it more than ever.

Similar regulatory initiatives are underway around the world in countries like Japan, Singapore, and Australia. Though the US government has been less forthcoming in enacting pro-Open Banking legislation, the Biden administration has given enough hints at boosting pro-Open Banking steps like the executive order issued on June 9,

As on the expected lines, it is tech leaders like CTOs and CIOs of fintech firms who must herald the new path to make customers future-ready by tapping the digital impulses of the times.

Want more market insight on why Open Banking is the go-to for fintechs looking to drive customer acquisition?

Open Platform Banking has enriched the Fintech companies’ goals in the following ways:

- Open Banking System allows Fintechs to access consumer banking trends alongside individual account details from banks. They leverage these insights to design innovative financial products for end customers.

- Fintechs get an opportunity to offer frictionless customer experience in real-time through innovative financial tools like PFM, credit services, wealth management, etc.

- Post pandemic, the use of mobile banking channels has increased by 20-50% and is expected to grow even further. Fintechs have an upper hand with their tech-driven Open Banking business framework to leverage this trend and gain profits.

- With the vast amounts of data being shared, Fintech firms can bridge the gap between ‘what traditional banks offer’ and ‘what customers expect’ with speed and efficiency.

- They also get the chance to partner with distinguished banks and access the banking data of their distinguished customers. Conversely, banks must also scout for the best Fintech firms in the market to collaborate with and promote customer acquisition and retention through improved banking services and tools.

- This partnership allows the freedom to test new ideas beyond the infrastructural and cultural constraints of banks and helps overcome internal obstacles to innovation.

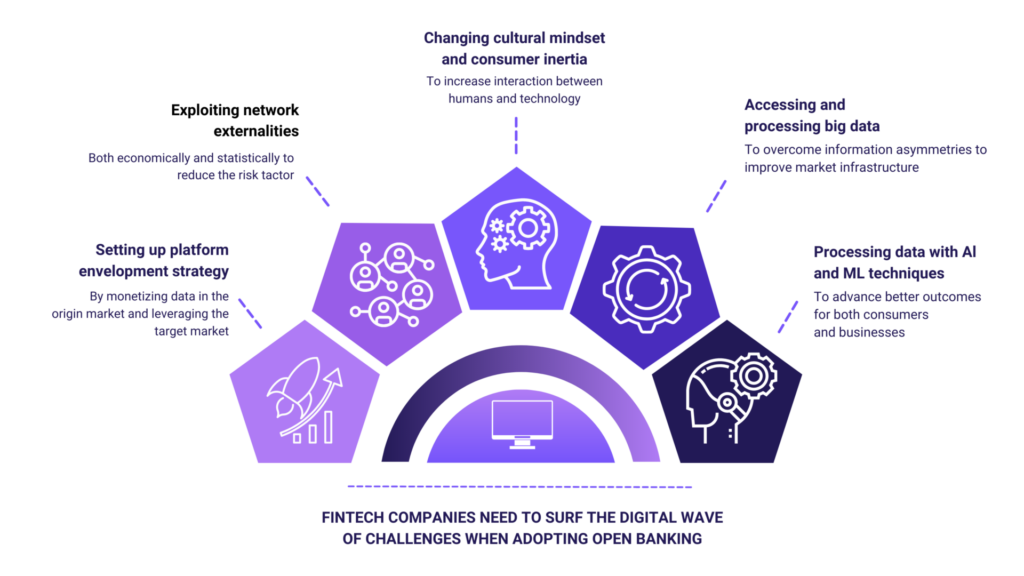

What are the pain points that Fintech firms have to navigate to ensure end-benefits from Open Platform Banking?

As digital transformation is gathering more pace, customers are looking for faster, better, and more seamless experiences. This calls for burning the midnight oil on the part of CTOs and CIOs at Fintechs to be more agile and keep pace with market trends and competition.

To further elaborate the above-showcased challenges, here is a bit of detailed explanation on what it is all about:

- Since Fintechs bring with them a culture of disruption, tech leaders have to come up with the necessary gateway to innovations as they operate outside the purview of the traditional banking framework.

- Also, the prime focus of CTOs and CIOs at fintechs must be – bringing out the core competencies while sharing the burdens of compliance, risk, and costs with financial institutions (banks).

- The Fintechs have to rely on more rigorous systems to continually seek consumer consent for data to be shared.

- The type and volume of banking data shared are incredibly extensive and Fintechs need high-end software to manage and process the same usefully.

- The firms also have to consider consumer inertia and the resulting delay in time-to-value when introducing newer financial products and services in the market.

- They have to be capable of easily building, training, and deploying machine learning models.

- Fintechs must leverage artificial intelligence (AI) to make real-time predictions much easier.

- Network externalities are the result of choices made at various levels of the design of a product: data format, GUI metaphors, API, and so on. They decide the level of interoperability, compatibility, and flexibility permitted within the use of the product.

- Exploring platform envelopment strategy to monetize data from the banks to create new financial products for the consumers – B2C and B2B.

Open Banking Platform significantly enhances user experience, which implies higher automation, more time to focus on other core areas, elimination of manual task hassles, and eventually cost-saving for businesses (B2B) and better ways to spend, borrow, and invest for customers (B2C).

How do APIs contribute significantly to a seamless Open Banking experience for Fintechs?

Application Programming Interface (API) enables cross-communication between various systems. Fintech companies use APIs to enable data access in financial transactions among the involved entities like – banks, third-party providers (TPPs), consumers, and websites.

Banks, e-commerce companies, merchants, and similar entities must connect with Fintechs to expand their services and stay competitive in the market. This is achieved through financial solutions like apps and tools innovated by Fintechs with the help of data gained via Open Banking APIs.

APIs are the building blocks that provide a highly-defined and customized infrastructure to access, regulate, and process relevant data. This data is then channeled into creating customer-driven financial products and services.

Change tech trajectory with Techwave’s APIs

With advanced services and technology, Techwave (a software solutions company, established in 2004) has been changing the digital landscape in the US. Techwave’s systems, known for their intelligent automation, industrialized assets, specialized skills, and global delivery capabilities are scalable and interoperable. This empowers them for faster data exchange in both internal and external applications.

Techwave’s ‘Cloud First’ framework is meant for addressing technology and business challenges while modernizing enterprise applications. Its API-enabled or Microservices-based applications ensure transformation on multi-cloud/hybrid environments.

By harnessing the power of Microservices, API Gateways, and Enterprise Serial Bus platforms such as Mulesoft, Techwave’s Enterprise Application Integration Services (EAIS) puts thrust on integration requirements by evaluating databases, workflows, applications, and security.

Techwave’s flexible and local language-friendly support operations embrace digital transformation to unlock applications and data silos for standard data definition, automated and connected workflows, and faster business processes.

Techwave has also created the Fintech Center of Excellence (CoE) which is dedicated to Fintech initiatives like Open Banking Software to deliver next-generation services and significantly decrease the time-to-market for global Fintech companies.

Low maintenance enterprise application integration from Techwave’s stable makes seamless integration between business processes hassle-free and easy to maintain post-deployment.

Curious to know how fintechs across the globe are implementing Open Banking to revolutionize financial services?

Security Mechanisms to protect Consumers and Providers and Enablers for Open Banking

Open Banking lets consumers share their financial data with third-party financial products and service providers. This sharing of data is done through APIs (Application Programming Interfaces), which are a set of software rules that govern how different applications can interact with each other. While Open Banking has the potential to increase competition and drive innovation in the banking sector, it also raises important issues about security. Data sharing between multiple parties is the prime concern amongst customers, and there is a greater risk of it being compromised.

Get relevant insights on cyber security in the Fintech Sector

To combat security challenges in open banking, Techwave provides a simple, convenient, and secure experience when customers are transacting. We’re committed to developing innovative security mechanisms to protect consumers, providers, and enablers for open banking. For instance, Techwave uses a robust framework to deliver high-quality banking software products. We also use secure communication protocols to maintain privacy, integrity, and data authentication.

In this article, we’ll explore some of the security mechanisms provided by Techwave that have helped protect consumers, providers, and enablers of open banking. By implementing these measures, organizations can ensure that their data is safe and secure, and customers can, in turn, control their finances in a better way.

Networks

a. Adopt strategies such as Defense-in-depth and 3-tier network security models to protect the organization’s assets.

Build

a.Deep focus on alignment to various industry standards

b.Adopt OAWSP (Open Web Application Security Project ) Top 10 Security standards

c.Use tools such as SONAR, BlackDuck, and CheckMarx for automated reviews

Secure Communications

a.Use the latest TLS (Transport Layer Security) versions

b.Use certificates issued by highly trusted Certification Authorities. Do not use certificates issued by providers such as LetsEncrypt.

c.Always prefer mTLS (mutual Transport Layer Security) using client certificates for the system–system interactions.

d.Always white-list IP addresses of callers where possible

e.Use FIPS-approved algorithms only.

f.Use strong ciphers – for example, bit lengths of 2048 and higher for RSA and 256 or more for AES

g.Use HSMs (Hardware Security Modules) for storing crypto keys and performing crypto operations. Discourage the use of other lesser mechanisms such as Java key stores, Vaults, etc.

h.Prefer MLE (Message Level Encryption) over Transport Level Security as this gives better end-to-end protection

i.Use JOSE standards (JWE, JWS, JWK, etc.) for encoding and decoding messages

Databases

a.Clear classification of data assets as Sensitive (PI, PII, PHI) and Non-sensitive

b.Prefer microservice architectures that break datasets by Function and additionally by Sensitivity

c.Always use encryption-at-rest TDE (Transparent data encryption) to prevent data theft from disks

d.Always use encryption-in-transit for exchanging data with application clients

e.Never store sensitive data in clear.

Identity Management

a.Don’t use homegrown user and password strategies. Use Identity Management systems that are designed to work for social use cases using protocols and standards such as OAuth2, OpenID Connect, etc.

b.Prefer SSO where possible to reduce the number of authentication credentials required to be remembered

c.Build an ability to revoke tokens issued and force re-authentication

d.Limit the shelf-life of various Access and Refresh tokens. Less is better.

Logs, Exports, Notifications

a.Review carefully for the presence of sensitive data

Archive

a. Proactively archive (purge) data that is no longer required to be retained

Playground

a. Use anonymization and obfuscation practices when moving production data to other lesser environments

Techwave has enabled a secure authentication platform for providers and consumers. Also, it has permitted them to meet the stringent security requirements of open banking initiatives.

With our experience and expertise in developing innovative security products, we are well-placed to help our clients address the challenges posed by open banking. Techwave’s solutions have helped several organizations stay one step ahead of evolving cyber threats.