Banking and finance

Modern, Flexible, Resilient

The financial world stands at the cusp of a digital revolution, with massive opportunities for those who are ready.

overview

The cross-border payment industry is undergoing significant growth, with an estimated increase in value from $150 trillion in 2017 to $250 trillion by 2027. The World Bank is monitoring the global average cost of sending a $200 international payment, which stood at 6.01% in June 2022, and aims to halve this to 3% by 2030.

The G20 has established a roadmap to enhance cross-border payments to meet this target, which includes adopting ISO 20022 as the global messaging standard, harmonizing approaches to data protection and privacy, and adopting common data sharing standards. The roadmap also explores ways to reduce frictions in cross-border payments by examining factors such as screening frequency, value thresholds, intermediary dependency, interlinking payment systems, and reciprocal liquidity arrangements.

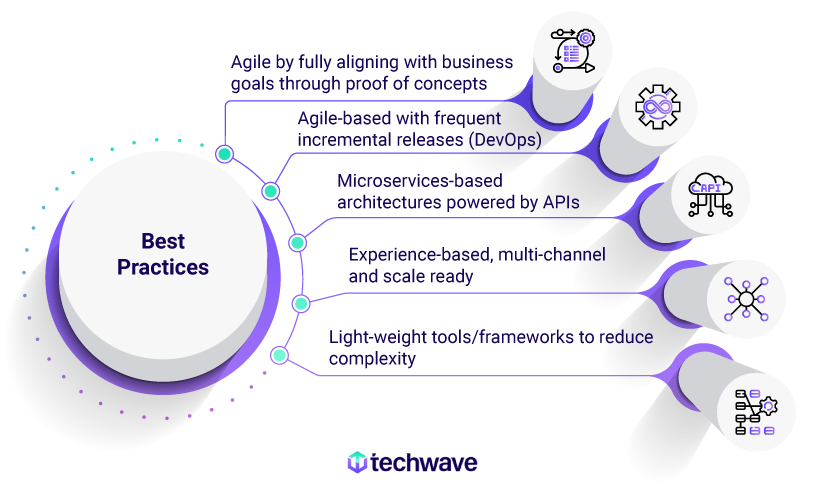

Techwave offers various banking and financial industry IT services and solutions to help companies navigate the challenges of the cross-border payment industry. These services include ISO 20022 Payments Data Management, App Modernization, and API Ecosystem Management. With its team of professionals, including data management specialists with extensive experience in the Cross Border Payments domain and ISO 20022 messaging standards, and technology experts with expertise in cloud-native systems and solutions, Techwave is equipped to help companies effectively manage their payments data, transform their legacy platforms into cloud-native systems, and effectively manage their API ecosystems.

OUR SERVICES

At Techwave, we proudly offer unparalleled services and IT solutions for the banking and finance sector. Our unique combination of domain expertise, technological know-how, and exceptional delivery capabilities allows us to create customized IT solutions for financial services tailored to meet each client’s needs. With a proven track record of success, we have established ourselves as the premier provider for forward-thinking financial institutions. Our strategies and IT solutions for the banking and finance sector are designed to help our clients stay ahead of the curve. By harnessing the power of cloud computing and big data, our solutions will give you the tools to transform your decision-making processes, stay ISO 20022 compliant, and remain at the forefront of the ever-evolving financial services industry landscape.

ISO Payments Data Management

Financial services industry is eager to adopt ISO 20022 and implement best practices for payments data management to reap the significant benefits of increased automation, faster processing times, improved reconciliation processes, reduced financial crime risk, and enhanced data-driven insights. These advancements will help organizations stay ahead in the rapidly evolving world of finance and enhance their competitiveness in the marketplace.

Our team of highly skilled data management professionals, with extensive experience in the Cross Border Payments domain and a deep understanding of ISO 20022 messaging standards, is poised to provide top-notch payments data management services. With expertise in organizing, storing, and analyzing payments data, our team is equipped to deliver comprehensive, effective, and reliable financial IT solutions for all your payments data management needs.

App Modernization

G20 aims to lower the average payment cost by adopting common data sharing standards, ISO 20022. However, this implementation presents challenges for banks, payment service providers, and fintech firms still using outdated platforms.

Techwave offers a comprehensive solution to address this issue, leveraging its expertise in Cross Border Payments, ISO 20022 messaging, and technology. Our services aim to modernize legacy systems in the BFSI industry and transform them into cloud-native platforms.

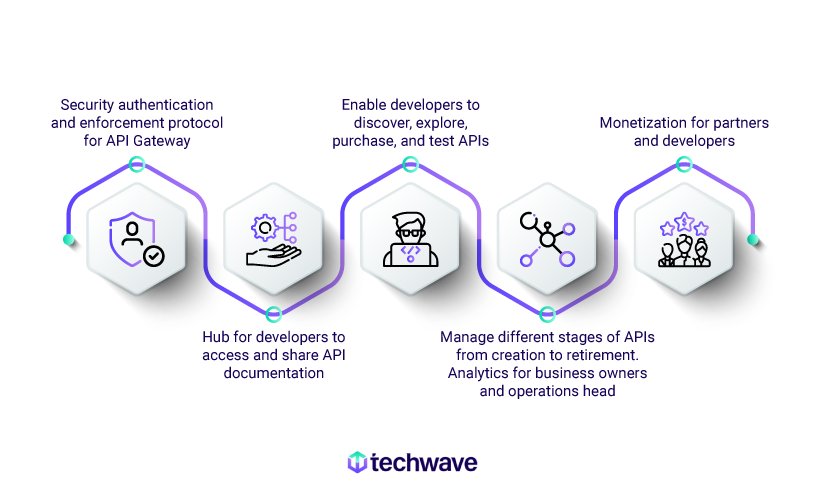

API Ecosystem Management

To streamline cross-border payments and minimize friction, banks and payment companies are exploring intermediary dependency, interlinking payment systems, and reciprocal liquidity arrangements. Compliance with regulations such as PSD2 is also a key concern for banks. To help meet these challenges, our team of technology experts offers a range of IT solutions for the banking and finance sector.

With extensive experience in cloud-native systems and solutions and proficiency in API ecosystem management, we are well-equipped to support your needs.

OUR EXPERIENCE

Payments

- Cross Border Payments

- Payment Acquisition

- Multi formats Payouts

- Settlements & Reconciliation

- Corporate-Bank Interactions

- APIs – B2B integrations

- Funds Management

- Push to Wallets

- Push to Accounts

Financial Messaging

- Message Validation

- Data Enrichment

- Transform Message

- Message Flow

- MT/MX Migration

- Message Formats (ISO 20022, SWIFT)

- Payment Rails

Compliance & Regulation

- Wire Transfer Regulation (WTR)

- Sanctions Screening

- Anti Money Laundering

- Clink, ComplyAdvantage, Guvnor, Actimize, RHDM

- Cash Management

- Treasury Management

- Settlements

- Margins & Quotes

- Rate Streaming

- Spot/Forward/Swap

- Retail & Corporate FX

- Realtime Feed Integration

Insights

Cyber Security Whitepaper

Cyber-attacks are an alarming threat to all types of businesses & organizations.The risk of a cyber-attack is not just a risk to your company but also to your privacy.Hence, cybersecurity is crucial for every business. Cybersecurity protects critical data from cyber attackers. This includes sensitive data, governmental and industry information, personal information, personally identifiable information (PII), intellectual property, and protected health information (PHI). If you are looking for tools to fight against cyber threats, then Techwave’s tools & technologies with adequate controls will help your organization stay protected.

Our Value Proposition

Advisory Services

- Strategy

- Assessment

- Business Requirement Analysis

- Migration roadmap

- Technology evaluation

- Determine services/solution framework

- Security framework

Delivery Execution

- Architect service/solution

- Setup policies, procedures, and processes

- Custom solution development

- Identify/Implement third party products/solutions

- System Integration

- Documentation

Support Services

- 24/7 SLA-based support

- Application Management

- Performance monitoring

- Root cause analysis and process/performance improvement

WHY TECHWAVE?

Techwave is a leading provider of services and IT solutions for the banking and financial services industry. With a proven track record of success and an enviable reputation as the go-to provider for forward-thinking financial institutions, our solutions are designed to help our clients stay ahead of the curve and remain at the forefront of the ever-evolving financial services industry.One of the areas where we excel is implementing ISO 20022 and best practices for payments data management. Our team of highly skilled data management professionals, with extensive experience in the Cross Border Payments domain and a deep understanding of ISO 20022 messaging standards, is poised to provide top-notch payments data management services. With expertise in organizing, storing, and analyzing payments data, our team is equipped to deliver comprehensive, effective, and reliable banking and finance solutions that bring significant benefits in increased automation, faster processing, more effective reconciliations, improved mitigation of financial crime risk, and better data-driven insights.

In conclusion, if you are looking for a provider to help you stay ahead in the rapidly evolving world of finance and enhance your competitiveness in the marketplace, look no further than Techwave. Our bespoke systems and expert team of professionals are poised to deliver innovative and effective banking and financial IT solutions that meet your unique needs and drive your success.

Banking and Finance

Let’s Get Started

Are you ready for a smarter, more productive approach to your business? Get in touch today.