The AI Revolution in Financial Services: From Rural Cooperatives to Global Giants

Contributor:

Naveen Kumar Gadda

Vice President 20.09.2025Reading Time:

7 Minutes

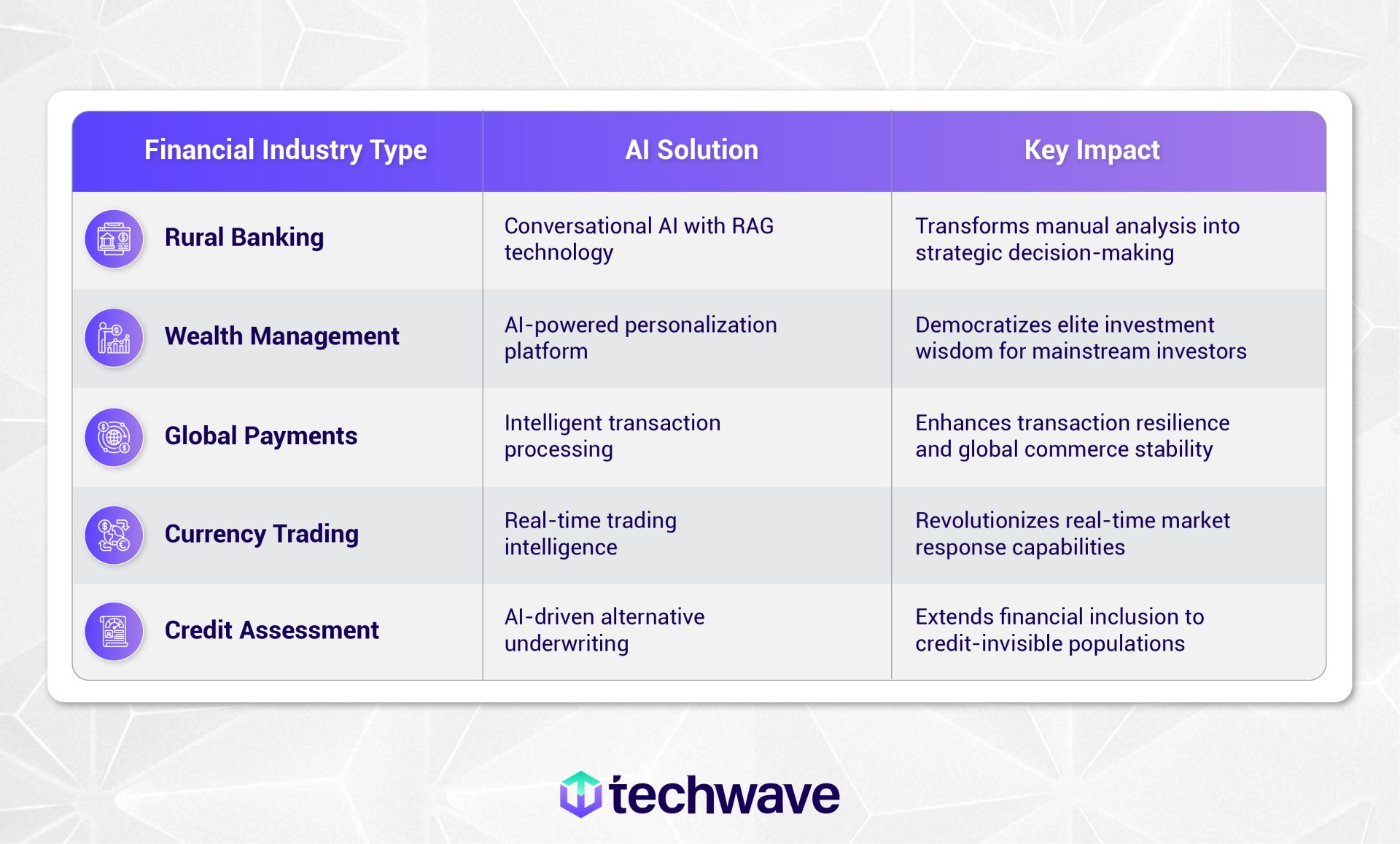

What if the most profound transformation in financial services isn’t happening on Wall Street, but in the wheat fields of rural Texas?

This surprising reality captures the essence of artificial intelligence’s sweep across finance—a revolution that’s rewriting the rules for institutions ranging from century-old cooperatives to trillion-dollar payment processors.

Yet, while 78% of organizations now use AI in at least one business function, only a fraction has achieved true mastery. The gap between adoption and transformation is wide. It’s not about whether companies experiment with AI—it’s about whether they can reimagine decisions, workflows, or customer experiences.

The numbers tell a compelling tale of accelerating investment. AI spending in financial services hit $45 billion in 2024, with projections climbing toward $97 billion by 2027. But these investments often stall – fragmented pilots that never scale, legacy systems built for obsolete workflows, and the persistent gap between technological promise and business reality.

So how do we separate those stuck in experimentation from those driving true transformation? The answer lies in stories—real institutions that bridged the gap between promise and performance. From a rural Texas cooperative to global trading desks, these examples reveal a common pattern: AI delivers its greatest value when it amplifies human intelligence, not when it tries to replace it.

Let’s begin where you might least expect it: a century-old cooperative at the heart of America’s agricultural economy.

How a Century-Old Cooperative Transformed Financial Analysis

Consider the story of America’s largest rural lending cooperative, a multi-million-dollar institution with over 100 years of heritage serving farmers, ranchers, and agribusinesses across 192 Texas counties. Its heritage is deep, but its challenges mirror those of the most modern banks.

Senior executives found themselves trapped in a weekly ritual of manual drudgery—spending 5 to 15 hours each month wrestling with financial reports, earnings analyses, and competitor filings.

Picture the scene: the COO’s desk covered with performance summaries from different teams, each using different data sources, creating conflicting numbers that demanded hours of weekend reconciliation before board meetings. Senior leaders grew frustrated spending precious time fixing data instead of making strategic decisions about business growth. During earnings season and merger evaluations, this manual burden became overwhelming.

The transformation came through a conversational AI system powered by Retrieval-Augmented Generation (RAG) technology.

What once required hours of document analysis became seconds of natural language questions: “Show me loan performance across our agribusiness portfolio” or “Compare this quarter’s defaults to last year.” The AI delivered precise answers in six seconds, complete with source citations for audit compliance. The results were extraordinary:

- 99.7% process efficiency improvement,

- 20+ hours saved monthly per executive, and

- 95% response accuracy with complete traceability.

More importantly, strategic leaders could now replace their manual data extraction with strategic decision-making backed by transparent, source-linked responses. Not only this provided faster turnaround during financial evaluations, but improved cross-team knowledge sharing also.

The rural story carried universal lesson: AI is projected to add $200 to $340 billion of annual value to global banking, but the biggest gains come not from replacing people, but from elevating their decisions.

And that same principle carries into other parts of financial services. If AI can free a cooperative’s leaders time to make smarter decisions about farming communities, what could it do for investment advisors trying to democratize wealth strategies?

How AI Turned Exclusive Investment Wisdom into Main Street Accessibility

Here is another story – a leading investment advisory firm with expertise serving ultra-high-net-worth individuals—boasting $7.2 billion in M&A transactions and 300+ institutional relationships—faced a strategic crossroads. Their relationship-driven model worked brilliantly for high-net-worth clients, but it couldn’t scale to reach the broader population. The challenge wasn’t capability but accessibility: How do you deliver institutional-grade investment wisdom to individual investors without diluting the premium experience that defines your brand?

The answer emerged through an AI-powered self-service platform that personalized investment strategies at unprecedented scale. By analysing spending patterns, life events, and financial goals, the system could detect subtle signals—and proactively recommend portfolio adjustments. What was once the preserve of elite advisors suddenly became available at scale.

The results underscored AI’s democratizing power: 20% year-over-year increase in investor base and 30% growth in investment volumes through customized recommendations.

And this wasn’t just a win for one firm. It reflects a broader market shift where active ETF assets are projected to leap from $856 billion in 2024 to $11 trillion by 2035, driven largely by AI-enabled personalization. In other words, the same intelligence that once guarded financial privilege is now fueling financial inclusion.

But personalization is only part of the story. If wealth management shows how AI expands access to financial expertise, the global payments ecosystem reveals how it safeguards the very infrastructure of modern commerce.

Inside the AI Revolution Powering Global Payment Networks

At the heart of global finance sits infrastructure most people never see—the payment processing systems that move trillions in daily transactions. One such system, operated by a company with half-trillion-dollar market capitalization and 60+ years of history, faced the mounting pressure of modern commerce demands. Their legacy platform struggled with real-time transaction processing, couldn’t scale to growing transaction volumes, and lacked the flexibility to support diverse payment use cases on a single platform.

The stakes were high: any fragility in this backbone of commerce could have created ripples through the entire global economy. The company responded with AI-powered transformation: intelligent routing to optimize transaction paths in real-time, automated compliance validation for multiple regulatory frameworks, and an API ecosystem enabling seamless data exchange with thousands of partners worldwide.

The impact was immediate:

- 50% faster transaction settlement times,

- 2+ million monthly transactions processed with 94%+ regulatory compliance,

- Successful geographic expansion into Latin America and Middle East markets.

But the significance runs deeper. Events like the May 6, 2010 Flash Crash, when markets plunged nearly 1,000 points in minutes due to algorithmic failures, demonstrated the shortcoming of financial infrastructure. Today’s AI builds antifragile systems that anticipates stress, adapts dynamically, and prevents collapse.

This resilience at the infrastructure layer sets the stage for transformation in the markets themselves.

And, if payment networks represent the hidden backbone of global finance, then foreign exchange markets are its beating heart—where the same resilience and intelligence must now be applied at trading speed.

How British Traders Conquered Currency Chaos with Real-Time Intelligence

Foreign exchange trading represents one of finance’s most demanding environments, where milliseconds determine millions in profit or loss.

A prominent British foreign exchange company with 200+ branches discovered just how exposed they were. Their clipper-based legacy systems, designed for slower eras, could no longer keep pace with real-time market demands.

Manual data consolidation processes delayed critical responses to currency fluctuations, while siloed systems blocked the real-time visibility traders needed for effective position management. In this market, every delay translated directly to lost opportunities and increased risk exposure.

The breakthrough came with the XTRIS AI-powered point-of-sale system.

By providing real-time trading intelligence across all branches and enabling swift responses to market changes with 24/7 availability, it enabled swift responses to market shifts. The transformation delivered 70% improvement in real-time position accuracy and 80% increase in operational efficiency.

But the lesson extends far beyond financial institutions: The same AI systems that empower traders to move faster are becoming the most effective defence against a darker trend: financial fraud. Deloitte predicts GenAI could enable financial fraud losses to hit $40 billion by 2027, up from $12.3 billion in 2023. Yet the irony is striking— the technology itself can prove to be the most powerful shield against those who exploit it.

Consider the example – a card used for coffee in London at 2:00 PM, followed by electronics purchases in Tokyo minutes later. Rules-based systems see two valid merchants and amounts. AI, however, recognizes the impossibility of human teleportation and blocks fraud in milliseconds.

This ability to see patterns invisible to traditional systems is more than just fraud prevention—it is the foundation for a fairer financial system. If AI can spot anomalies in split seconds, it can also recognize overlooked strengths in people’s financial behaviour. That’s why some of the most powerful applications of AI are now emerging in credit scoring, where technology is rewriting the rules of financial inclusion.

How AI is Rewriting Credit Rules to Include the Financially Invisible

Perhaps no area demonstrates AI’s transformative potential more clearly than credit assessment. Traditional credit models exclude 28 million Americans who are “credit invisible,” disproportionately affecting young people, immigrants, and communities relying on alternative financial services.

Modern AI-driven underwriting looks beyond traditional repayment history to behavioural patterns: reliability of utility payments, consistency of lifestyle spending, stability reflected in mobile usage patterns. A startup owner with short credit history might be declined by traditional systems, but AI can recognize early bill payments, consistent savings, responsible spending patterns over five years, and residential stability—creating a transparent and complete picture of creditworthiness.

This capability is no longer optional. With 52% of financial institutions now treat generative AI adoption in credit scoring as a strategic priority, enabling real-time credit pricing and expanding financial inclusion while maintaining prudent risk management.

And this points to the deeper truth running through every story—AI’s impact isn’t defined by pilots or proofs of concept, but by execution at scale.

Why Execution Separates AI Winners from Digital Wishful Thinkers

The financial services industry now stands at an inflection point. Nearly 70% of financial services companies reported AI-driven revenue increases in 2024, with most achieving 5-10% revenue growth. Yet the majority still struggles – only 32% of financial services companies are generating AI returns, while 67% remain stuck in experimentation.

The rural cooperative in Texas, the investment advisory firm scaling to millions, the payment processor enabling global commerce, and the FX company responding to market volatility in real-time—together, they represent the emerging blueprint of finance’s AI-powered future.

The winners share common characteristics: they treat AI as an enterprise-wide transformation rather than isolated experiments, invest heavily in data infrastructure and talent development, and remain relentlessly focused on business value over technological novelty. Crucially, they understand that AI’s greatest contribution isn’t simply automating existing processes but enabling entirely new possibilities.

Looking ahead, 25% of enterprises using GenAI are expected to deploy AI Agents by 2025, growing to 50% by 2027. These autonomous agents will manage complex workflows with minimal human intervention, from automated claims processing to sophisticated risk modelling.

The revolution isn’t coming; it’s already here. The question isn’t whether AI will transform financial services, but how institutions will lead that transformation while maintaining trust, security, and agility in a rapidly shifting landscape.