Introduction to CLV

Customer lifetime value (CLV) is a metric that represents the total net profit a company makes from any given customer. CLV is a projection to estimate a customer’s monetary worth to a business after factoring in the value of the relationship with a customer over time. CLV is an important metric for determining how much money a company wants to spend on acquiring new customers and how much repeat business a company can expect from certain consumers.

Importance of CLV

The Pareto Principle states that, for many events, roughly 80% of the effects come from 20% of the causes. This means that 80% of your revenue can be attributed to 20% of your customers. While the exact percentages may not be 80/20, it is still the case that some customers are worth a whole lot more than others, and identifying your “All-Star” customers can be extremely valuable to your business.

Taking CLV into account can bring a shift in customer acquisition strategies. Rather than thinking about how you can acquire a lot of customers and how cheaply you can do so, CLV helps you think about how to optimize your acquisition spending for maximum value rather than minimum cost.

Considering not just the acquisition cost, but also the value the customer will bring to your business. Acquisition strategy can be fine-tuned and result in better customers for less money.

Calculating CLV

CLV calculations vary wildly based on methodology. After all, the metric is a complex one to calculate – it includes not only the profits obtained so far from a customer, but expected profits in the future as well.

The following definition might be the one being used most commonly:-

| Where, | t is a period, e.g. the first year(t=1), the second year(t=2) |

| n is the total number of periods the customer will stay before he/she finally churns | r is the retention rate/possibility |

| Pt is the profit the customer will contribute in the Period t

|

d is the discount rate |

Predicting CLV

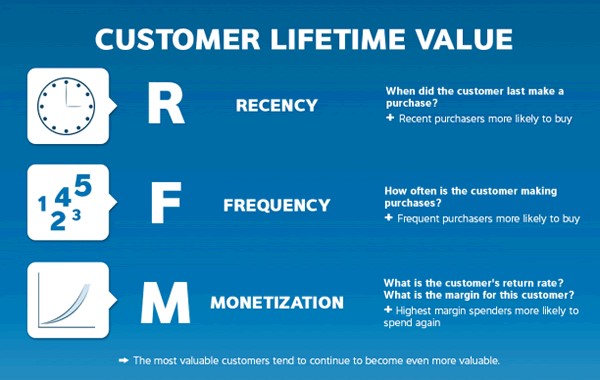

Traditionally marketers attempt to pinpoint the best customers with the help of tools such as RFM analysis. This technique measures how recently customers made purchases (R, Recency), how often they made purchases (F, Frequency), and how much they spent (M, Monetary value). This technique uses a linear regression based on the RFM to predict purchases by a customer and extrapolates it to find the CLV.

Newer approaches of modeling recognize that all customers are different – and it is this recognition of what academics call “customer heterogeneity”.

At a high level, the models work as follows:

- Observe various individual-level buying patterns from the past – find the various customer stories in the data set.

- Understand which patterns correspond with valuable customers and which patterns correspond with customers who are leaving for good.

- As new customers join, match them to these patterns accordingly.

These approaches involve more complicated modelling and employ several machine learning techniques such as Clustering, KNN classification and cross-validation.

Benefits:

- Defining objectives

- Alternative market strategies

- Segmentation of customers

- Forecasting with customer satisfaction

- Market communication

- Customer service

- Loyalty programmes

- Early warning systems

- Marketing campaigns

- Reactivating inactive customers

- Complaint management

- Defection/Churn

- Win-back