Imagine a bank pouring millions into a cloud-based technology overhaul. Their goal? Digital transformation – reduced costs, a competitive edge, and a stellar customer experience. Initially, they excel at agility, data-driven decisions, and hitting those crucial ROI targets. Everything’s fine, and then suddenly, a disaster strikes. A hefty fine for risk violations exposes a critical oversight: neglecting risk and security during the transformation.

As McKinsey stated, a $200 million revenue increase driven by digital transformation loses significance if a company faces $300 million in penalties due to risk violations!

Unfortunately, this scenario plays out across industries all too often. Companies embark on ambitious digital transformations, laser-focused on becoming “more digital”—faster, data-driven, and responsive. Only later (sometimes after a costly penalty) do they realize their risk and compliance oversight.

With its heavy regulations, the financial sector often feels the brunt of these issues most acutely, but it’s far from alone; the impact ripples outward. Companies across industries, from manufacturing and retail to healthcare, all rely on financial institutions. As a result, trends and risks in finance inevitably have a direct or indirect effect on these businesses. This underscores the need for a balanced approach to digital transformation in all sectors – one that prioritizes both innovation and robust risk management.

So, can banking and other finance companies be truly innovative AND secure? To make it simpler, how can the financial industry leverage digital transformation to gain a competitive edge without compromising risk management?

The answer lies in leveraging Artificial Intelligence (AI) solutions that bridge the gap between innovation and security.

Financial Foresight: The Power of AI in Risk Mitigation

Forget “doing more with less” – Artificial Intelligence is redefining risk management for financial institutions. Generative AI (GenAI) takes it a step further, creating entirely new possibilities. Its integration into banking operations foreshadows a significant transformation in the industry landscape. McKinsey predicts a revolution in financial risk management by 2030 thanks to GenAI. This isn’t about efficiency tweaks; it’s about crafting personalized experiences, generating innovative products, and fundamentally changing how finance works.

Here’s why it’s so disruptive – building on traditional AI that analyzes data and provides insights, GenAI uses the same data to generate entirely new outputs. Imagine fraudsters constantly innovating their tactics. Traditional models struggle to keep pace, but generative AI can analyze historical fraud AND invent new scenarios to predict and prevent future attacks. This translates to a powerful weapon against financial crime, a critical area for banks facing stricter regulations, steeper penalties, and the ever-present threat of cyberattacks. GenAI isn’t just an upgrade – it’s a shield for the future of finance.

McKinsey predicts GenAI could add a staggering $200 billion to $340 billion annually across industries, including banking. But here’s the catch: given that traditional AI in financial services analyzes data to recognize patterns, while GenAI invents entirely new patterns, it opens a backdoor for “hallucinations” – misleading data that can be disastrous, like deepfakes fooling investors.

Despite this risk, 70% of financial leaders surveyed by Gartner believe the benefits outweigh the risks. The key is to find the sweet spot – harnessing the power of GenAI for groundbreaking risk mitigation while vigilantly monitoring its potential pitfalls. It’s a new frontier, but with cautious optimism, AI has the potential to revolutionize financial security.

Revolutionizing Risk Management with The Power of AI

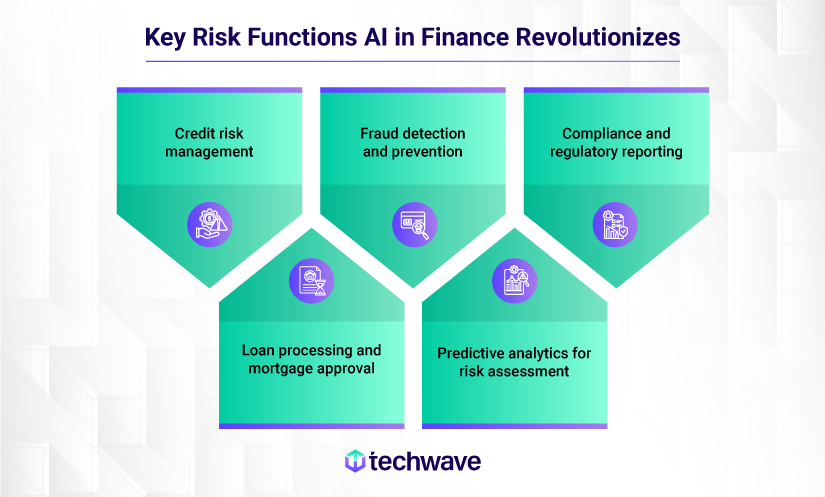

AI in risk management is a game-changer, transforming financial institutions from reacting to risks to proactively shaping the entire landscape. Here’s how artificial intelligence in finance can revolutionize key risk functions:

1. Credit Risk Management

Managing credit risk is a high-stakes game for large companies. Their portfolios include a complex mix of borrowers across languages, currencies, and even intricate parent-company structures. One misstep—a defaulted loan or counterparty failure—can trigger a financial domino effect, leading to distress, insolvency, or even bankruptcy.

Traditional credit risk management methods are slow, subjective, and have the following limitations:

- It is a manual slog. Gathering borrower information, assessing creditworthiness, and monitoring performance all rely on human judgment – a recipe for errors, inconsistencies, and biases.

- They suffer from limited data analysis. They often rely on a narrow set of data (credit scores, financials, payment history) to evaluate creditworthiness. This narrow approach can result in incomplete risk assessments and inaccurate judgments of the borrower’s creditworthiness.

- They are expensive and time-consuming, requiring significant resources. This slows down decision-making, potentially missing opportunities and impacting profitability.

McKinsey discovered an average 4-5% reduction in credit risk Full Time Equivalents (FTEs) between 2021 and 2023, mainly within the credit underwriting sector. This decline was primarily attributed to the ongoing automation of the underwriting process, and as we all know, AI plays a significant role in automation.

Due to this, legacy, manual processes are giving way to the powerful AI-ML combo. This unlocks deeper borrower insights, sharper credit decisions, and streamlined operations.

Moreover, GenAI can source and analyze credit data to assess customers’ risk profiles and estimate default and loss probabilities using models. These tools can scan vast sets of credit information from internal and external sources, generating warning alerts with a severity index for review by the credit department. Alert frequency can be near real-time and tailored based on parameters like exposure, borrower financial standing, and adverse market screening.

This isn’t just about banking. AI transforms risk assessment, prediction, and daily operations across financial sectors like insurance, wealth management, capital markets, and Decentralized Finance (DeFi). For example, AI uses ML methods that learn from data without rule-based programming, enhancing their ability to fit data patterns effectively. This is accomplished through classical ML algorithms and deep learning techniques, including logistic regression, support vector machine (SVM), neural networks (NNs), etc.

LendingClub, among the largest peer-to-peer lending platforms in the United States, extensively employs AI algorithms for credit scoring and risk assessment. Analyzing loan data, Lending Club identifies patterns and factors affecting loan defaults or delinquencies. This allows for more precise credit risk assessments, appropriate interest rate setting, and enhanced risk management overall.

2. Fraud Detection and Prevention

Fraud-related losses in the US are skyrocketing – McKinsey reports a staggering 60% annual surge since 2019. But the damage goes beyond financials. The survey reveals a concerning trend – 70% of fraud victims surveyed felt anxious, stressed, or upset when warned about potential fraud. This fear can erode customer trust and willingness to use essential services.

Traditional fraud detection methods simply can’t handle:

- New fraud schemes: They struggle to adapt to ever-more sophisticated scams.

- Digital explosion: The sheer volume of digital transactions overwhelms them.

The result? Poor customer experiences as outdated systems trigger false positives.

AI-powered enterprise risk management solutions or tools provide organizations with real-time data analysis, allowing them to block suspicious transactions or request verifications promptly. As these AI/ML models grow hungrier for information, their accuracy soars, minimizing false alarms. Google Cloud’s AI anti-money laundering tool is a prime example.

This isn’t just about prevention—GenAI expedites fraud investigations. By streamlining data collection, it frees up analysts to focus on real threats. Take PayPal—thanks to GenAI’s power, they halved their losses despite a massive surge in transactions (from $712 billion to a staggering $1.36 trillion).

3. Compliance and Regulatory Reporting

Generative AI automates compliance testing and reporting in finance. How?

- Automates analyses: Tedious regulatory analyses become a breeze with AI. Faster, more accurate reporting keeps financial institutions on top of compliance.

- Simulates data: GenAI creates realistic, fake data for testing, allowing banks to safely evaluate their systems without real customer information.

Also, you can forget mountains of paperwork – GenAI injects flexibility, reliability, and trust into bank compliance. Imagine AI bots that scan legal documents in seconds, personalize compliance training, and translate regulations on the fly. How?

Natural Language Processing (NLP) empowers chatbots to deliver real-time support and personalized training, while predictive analytics identify and mitigate risks before they become problems. The result? Alongside streamlined document creation, personalized training and a future-proof approach to global compliance through language translation and localization.

4. Loan Processing and Mortgage Approval

Here’s how GenAI transforms loan processing (reiterating a few points here as they are equally relevant to this key finance function):

- Fake data for real results: It generates realistic borrower profiles to train AI models, making them smarter at assessing risk.

- Goodbye paperwork: AI automates document verification, eliminating manual review and saving time.

- Faster decisions, happier borrowers: Streamlined underwriting leads to quicker loan approvals, boosting borrower satisfaction.

- Fraud detection in loan applications: ML algorithms aid banks in identifying discrepancies in loan applications. In the digital age, fraudsters frequently resort to identity theft for fraudulent applications. Given the evolving threat landscape, without AI and ML models, banks will struggle to efficiently process applications while ensuring accuracy and authenticity.

5. Predictive Analytics for Risk Assessment

Imagine having a crystal ball for your finances. Predictive analytics brings that vision closer to reality. By harnessing big data mining, statistics, and powerful AI/ML modeling techniques, these tools analyze vast datasets to uncover hidden patterns and trends in historical data. This translates into tangible benefits for finance teams:

- Forecasting cash flow with confidence: Predictive analytics lets you build cash flow forecasting models that are more accurate than ever. Imagine – analyzing invoice data, cross-border payment trends, and your current cash position to predict future inflows and outflows. This empowers proactive planning for investments, customer segmentation, and optimal cash flow management.

- Know your customers better & predict payments: No more chasing after late payments! Predictive analytics algorithms analyze past payment behavior, financial health, and market conditions. This enables finance professionals to prioritize accounts and tailor interactions, focusing resources on customers more likely to settle dues promptly.

- Budgeting with laser focus: Predictive analytics goes beyond historical data. It identifies patterns and trends that help you predict the ROI for different budget allocations. This means smarter resource allocation strategies – avoiding overspending or underspending and getting the most out of your budget.

- Turning accounts receivable into assets: In the accounts receivable industry, timely collection is crucial. By analyzing payment behavior and industry performance, the company can assess client and debtor creditworthiness before transactions. This early risk identification paves the way for informed decisions on credit limits, pricing, and risk mitigation strategies.

In addition to the above benefits, predictive analytics offers actionable insights that help in:

- Sending personalized reminders via the most effective channel (text, email, phone) at the optimal time, maximizing response rates

- Offering tailored options like delayed payment plans to incentivize timely payments from high-risk clients

While the potential of AI in financial transformation is undeniable, harnessing its power for maximum ROI requires a strategic approach. Digital transformation itself presents a conundrum – it unlocks agility and growth, but neglecting risk management can lead to crippling setbacks.

Techwave: Your Bridge to Secure and Scalable AI in Finance

Techwave bridges this critical gap with AI-powered solutions designed to empower your financial institution. We transform payments with AI, demonstrably ensuring faster transactions for retailers and professionals. We leverage cutting-edge generative AI to elevate the user experience, making payments not only swift but also secure and personalized. This dedication to innovation positions us as a leader in the payment industry, and we are committed to delivering a future of seamless and tailored transactions.

We empower financial institutions to navigate the complexities of digital transformation with confidence. Explore our client success stories to gain deeper insights into how Techwave can propel your organization forward. Additionally, our team of experts would be happy to discuss your specific requirements and tailor an AI-powered solution that seamlessly integrates with your existing finance infrastructure. Reach out to us for further details.