Imagine a world where doctors can perform surgeries remotely, robots in factories work alone, and cars smoothly drive through cities without anyone steering. This isn’t a movie plot – it’s what the next-gen wireless tech, 5G, can make happen. Beyond being fast, 5G technology can change how entire industries work and how we live each day.

The journey toward this 5G-driven future hinges not only on technological advancement but also on the strategic interplay of forward-thinking policies, industry decisions, and a global perspective. In this blog, we embark on an insightful exploration, focusing on:

- Exploring the Current European Landscape: A Global Perspective

- The Roadblocks to 5G Rollout in Europe

- European Union’s (EU) Digital Connectivity Goals

- EU’s Policies and Initiatives for 5G deployment

- Is there a need for EU industrial policy changes to improve 5G networks?

- Industry Insights and Applications

Exploring the Current European 5G Landscape : A Global Perspective

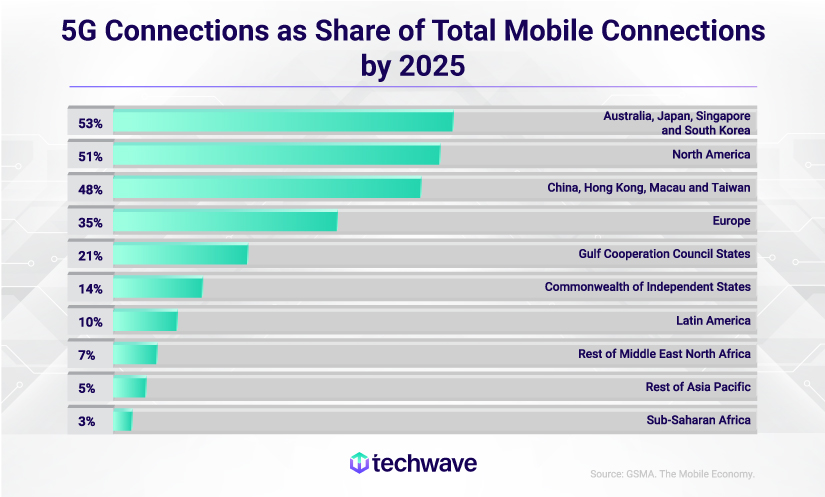

The global race to deploy 5G networks has intensified in recent years. Here’s a glance at the comparative stand of regions leading the 5G race:

Asia-Pacific takes the lead: Australia, among other Asian nations, stands tall with blazing 5G speeds and widespread 5G coverage, setting a benchmark for the world.

Europe’s mixed bag: While countries like Germany and Finland are making strides, others are lagging. Bridging this gap requires effective public-private partnerships, drawing inspiration from success stories in Japan and South Korea.

Moreover, the ongoing war in Ukraine, like other sectors, has impacted the telecom industry, too. According to McKinsey, the potential consequences of this technology gap are substantial for the EU, with corporate value added of €2 trillion to €4 trillion per year at risk by 2040.

Key findings from the European Telecommunications Network Operators (ETNO),

- In a continental comparison, the Asia-Pacific region has the highest number of standalone 5G services, boasting 15 active services. There are currently four standalone 5G services in Europe, while North America has three.

- In 2022, 5G population coverage in Europe increased to 73%, compared to 62% in 2021. However, Europe still falls behind its global counterparts, as the USA nears 96% coverage, South Korea at 95%, Japan at 90%, and China at 86%.

Also, a McKinsey article states that telcos can make the most of the 5G opportunity primarily through two cornerstones of 5G business horizons: core connectivity ($10-20 billion by 2028) and premium connectivity ($30-50 billion by 2028). However, many European telcos are caught in the crossfire, striving to be successful in both core connectivity and beyond while managing a costly integrated operating model.

It’s apparent: delays in 5G deployment in Europe are not solely linked to the choice of technology vendor; Europe grapples with structural challenges hampering 5G development .

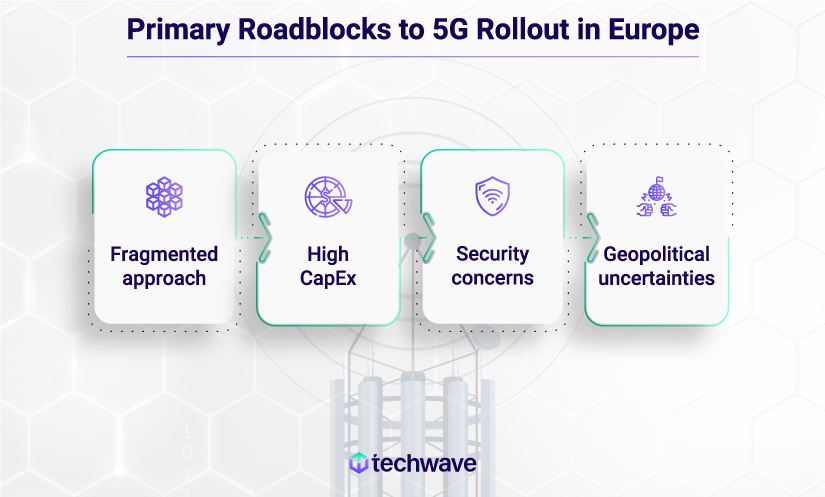

The Roadblocks to 5G Rollout in Europe

Some European regulators and operators adopt a ‘wait-and-see’ approach from their Asian and American counterparts before accelerating 5G deployments, which has proven challenging for EU 5G goals. Following are a few other critical challenges that impede EU 5G proliferation:

Fragmented approach

The European digital market is highly fragmented in nature. The European Union (EU) consists of multiple countries with differing laws and regulations, making it difficult for companies to operate seamlessly across borders.

For example, The 3.6 GHz band is widely assigned in the EU, with almost 84% of its spectrum allocated in 25 out of 27 Member States. In contrast, the 26 GHz band is assigned in only 8 countries, with less than 30% of its spectrum utilised. Different approaches in Germany and Italy cause fragmentation and usage challenges. There are disparities in reporting 5G coverage and service quality across EU states. Harmonising reporting methods and prioritising key bands, like 3.6 GHz, is crucial for delivering high-speed 5G services to consumers across Europe.

High CapEx

The challenging investment environment for European service providers, struggling to generate sufficient returns, hinders justifying investments in new technology. The telecom industry exhibits high capital expenditure (CapEx) intensity. European telcos have invested a substantial amount of money, about EUR 500 billion, in building fixed and mobile networks over the past ten years. EU commissioners say that Europe needs to invest much more in its telecom networks to address security issues and navigate a complex and heavily regulated market. They estimate a gap of EUR 174 billion to reach the current network quality and coverage goals.

For example, in the EU, there’s an issue with spectrum auction pricing, licences that mobile companies purchase for services like 5G. High auction prices challenge new market entrants. Mobile network operators (MNOs) argue that these costs limit their investment in 5G networks , causing delays. Comparing licence prices, especially for mid-band spectrum, Europe’s average isn’t overly high compared to Canada and the US. The problem lies in substantial price variations among EU countries. For instance, Italian operators pay eight times more per megahertz than Finnish operators for the same spectrum. The price disparity among EU countries challenges achieving a consistent and equitable deployment of 5G networks in Europe. It complicates investments in 5G services, resulting in a fragmented approach to rolling out 5G networks in different countries.

Security concerns

As 5G networks are expected to underpin various services and applications, ensuring their availability becomes a significant security challenge for individual countries and the EU. If hackers were to infiltrate a 5G network, they could disrupt services or take control of critical infrastructure, especially those with cross-border implications in the EU. Regarding 5G network security, it’s not explicitly defined as an EU responsibility in the treaties. This security matter falls within the purview of EU competencies and areas managed by individual countries.

Geopolitical uncertainties

Given its reliance on technology from both sides, Europe finds itself in a challenging position in the US-China tech competition. This dependence makes Europe vulnerable. Additional pressures come from geopolitical uncertainties – the energy market effects of Russia’s conflict in Ukraine and businesses moving to the US due to the US Inflation Reduction Act.

As per McKinsey, Europe’s current per capita GDP is 30% lower than that of the United States. The gap had been narrowing but is no longer doing so.

European Union’s (EU) Digital Connectivity Goals

The European Commission (EC) has established ambitious goals for the EU’s digital development, emphasising key technological domains like Electronic Communication Networks (ECN). The Digital Decade 2030 (explained later in the article) strategy aims to expedite the EU’s digital transformation, ensuring competitiveness in the global digital economy with specific targets in key areas.

- The EU strives to make Europe the most connected continent by 2030, with goals including full gigabit network coverage for households and businesses, deployment of 5G networks in all populated areas, and the establishment of 10,000 climate-neutral, highly secure edge nodes.

- These digital targets underpin the EU’s formation of a Digital Single Market, reinforcing digital sovereignty with a focus on data, technology, and infrastructure. The ultimate objective is to enhance global competitiveness in the digital realm and decrease reliance on foreign technology providers.

The Digital Compass 2030 (European Commission, 2021) accompanies this initiative, encompassing a set of digital rights. Moreover, it incorporates a set of supporting pillars with corresponding targets for 2030.

EU’s Policies and Initiatives for 5G Deployment

According to McKinsey, the EU plans to allocate 160 billion euros by 2027 to narrow the technology gap between Europe and its competitors on various metrics, which is expected to boost the demand for new telecom services.

European policymakers are adopting a coordinated approach to establish secure rules for 5G networks, considering the health implications of fifth-generation networks.

- The EU’s 5G roadmap, initiated with the 2013 launch of the 5G-PPP, strives to provide solutions for next-generation communication infrastructures, securing Europe’s leadership in key areas and fostering new markets.

- In its 2016 5G Action Plan, the Commission aimed for uninterrupted 5G coverage in urban areas and along main transport routes by 2025. These ambitions have intensified with the 2030 Digital Compass (European Commission, 2021), which establishes the deadline of 2030 for achieving 5G coverage in all populated areas.

- The EU’s Cybersecurity Strategy, approved in December 2020, emphasises 5G in two key ways: initially, suggesting the sharing of the EU’s 5G Toolbox model with non-EU countries, and secondly, allocating a dedicated appendix to 5G within the Strategy document.

- European policymakers’ enthusiasm for ambitious 5G deployment targets faces challenges with a slower-than-expected implementation. The European Union’s Digital Decade target aims for gigabit connectivity and ubiquitous 5G coverage by 2030 to support digital transformation. However, a report by the European Court of Auditors (ECA) warns that Europe is falling behind the 2016 Action Plan targets.

- On December 17, 2021, the EU presented the initial comprehensive 6G Research and Innovation Work Programme, followed by the second one on December 15, 2022.

- Expectations are optimistic that the recently proposed Gigabit Infrastructure Act will expedite and cost-effectively enhance network deployment by reducing administrative costs and burdens, streamlining and digitising permit procedures, promoting the joint use of physical infrastructure, and facilitating the deployment of fibre networks. Additionally, the Commission has introduced a Gigabit Recommendation, guiding National Regulatory Authorities on leveraging available tools to incentivize quicker network deployment.

- In July 2023, the Commission, as part of its Work Program 2023, declared a legislative initiative to establish the new Radio Spectrum Policy Programme (RSPP 2.0) in Q3 2023.

Is there a need for EU industrial policy change to improve 5G networks?

The GSMA recently published “The Mobile Economy Europe 2023” report, examining the current state of the mobile industry in Europe and providing forecasts up to 2025. The findings underscore the urgency of taking swift policy and regulatory actions to achieve the objectives outlined in the European Commission’s Digital Decade.

These significant challenges prompt several crucial questions for European policymakers. Chief among them is the pressing strategic question:

- What specific measures can be implemented to facilitate the on-field rollout?

- How should a mobile policy be structured to reinforce future strategic autonomy, especially in the digital realm?

If policymakers are committed to providing gigabit connectivity and fostering cross-sector innovation that can fuel telecom companies’ growth, then we require a comprehensive policy shift. European operators are caught in a detrimental cycle, consistently underinvesting in their networks.

To prevent Europe from lagging, policymakers should:

- Revise spectrum and infrastructure policies to ease financial burdens on mobile network operators, enhance cross-border coordination, and reduce regulatory obstacles to site buildouts.

- Introduce public funding programs, potentially at the European level, to support investments in high-capacity digital network infrastructure, especially in rural areas.

- Establish effective and transparent processes to expedite the deployment of high-capacity infrastructures, including fibre and 5G.

- Timely implement relevant measures aligned with the 5G cybersecurity toolbox.

- Ensure coordinated availability of 5G spectrum at reasonable prices.

- Revise regulations and policies to prioritise mobile operator’s ability to generate capital for investment in new technology than focusing solely on short-term lowest mobile broadband prices.

- Prolong the lifetime of spectrum licences to increase investment certainty for operators.

- Enhance cross-border cooperation by promoting homogeneity and standardisation. This encourages SMEs and investors concerned about the lack of homogeneity and standardisation in 5G-related business models, impacting scalability, SME valuation, and investment levels.

- Foster interaction between very early-stage SMEs and angel investors.

- Offer clarity on financing options through advisory services.

- Take the initiative to provide investment support and incentives, address the investment gap, and foster technology development in critical areas.

- Facilitate collaboration among regulators, network operators, and equipment manufacturers on policy, platform, and technology interoperability to unlock scale at the national and European levels, fostering value chain partnerships.

Lastly, in the short term, the EU must encourage its member states to collaborate, using diverse 5G suppliers for competition and reducing reliance on one source. In the long term, the EU may want to form a consortium of European companies, possibly with public funding, to decrease any possible influence of nations outside the EU, enhancing control over technology.

Industry Insights and Applications

A special report by the European Court of Auditors suggests that by 2025, 5G could add a staggering €1 trillion in GDP for Europe, concurrently generating an impressive 20 million jobs.

5G emerges as a key player in managing environmental impact across various sectors such as water, energy, waste, transport, construction, and smart cities. As we know, better connectivity is the top EU priority. With this, Europe can achieve the goal of reducing carbon emissions. How?

Consider the case of automation in smart manufacturing. Fewer workers are needed when the assembly line and processes in a factory are fully automated. This not only saves their travel time and fuel but also reduces carbon emissions.

5G also offers alternatives to business travel and real-time energy and resource consumption optimization, effectively preventing wastage. In essence, 5G holds immense potential to support regions and businesses in their ecological transition, aligning with global efforts to address environmental challenges.

Similarly, the following are some emerging applications of 5G across industries:

- Healthcare Evolution: The integration of 5G facilitates transformative shifts in healthcare, from remote surgeries to real-time patient monitoring and AI-driven diagnostics.

- Manufacturing Renaissance: Smart factories equipped with self-optimizing production lines, robotic automation, and real-time data analytics promise a surge in efficiency and productivity.

- Transportation Transformation: The advent of autonomous vehicles, intelligent traffic management systems, and connected logistics holds the potential to reshape urban mobility and logistics.

- Entertainment Revolution: Immersive VR/AR experiences, ultra-fast cloud gaming, and hyper-personalised content delivery are set to redefine the realms of entertainment and leisure.

Conclusion

Once a pioneering force in mobility, Europe must swiftly re-enter the competitive technology race. Its innovators, businesses, industries, and citizens deserve no less. The era of playing catch-up has persisted for too long. The challenges posed by 5G are crucial for the EU and extend to the future technology, 6G. These pressing challenges pose questions critical to European policymakers.

Even though 6G is in its early stages, there’s already a global competition for leadership. To stay relevant and competitive globally, the EU may need to treat the development of 5G (and later, 6G) as a significant issue for the entire European market. If the EU is falling behind in 5G due to these reasons, the only way to improve is through effective policies at the European level.

We can look forward to a positive outcome in line with the above recommendations from the European 5G Conference 2024, held in Brussels. As stated by the EU industry chief Thierry Breton – “We have announced that Europe will do ‘whatever it takes’ to keep its competitive edge, and we are looking for concrete and ambitious recommendations on the future of 5G Single Market.”

Did you like the article? Do you have further insights to share? Connect with us!

Share your thoughts on how industry, policymakers, and innovators can bridge the gap between 5G promise and reality. And consequently, what exciting opportunities do you envision in your field?