The evolution of FinTech (Financial Technology) drastically transformed the way traditional financial institutions – insurers and banks functioned. To thrive, global companies, retailers, and large tech giants realized the need to reinvent the value chain of financial services.

We have come a long way from conventional financial services to FinTech. The future of finance couldn’t have looked brighter than it seems now. But was FinTech always this disruptive? Let’s find out.

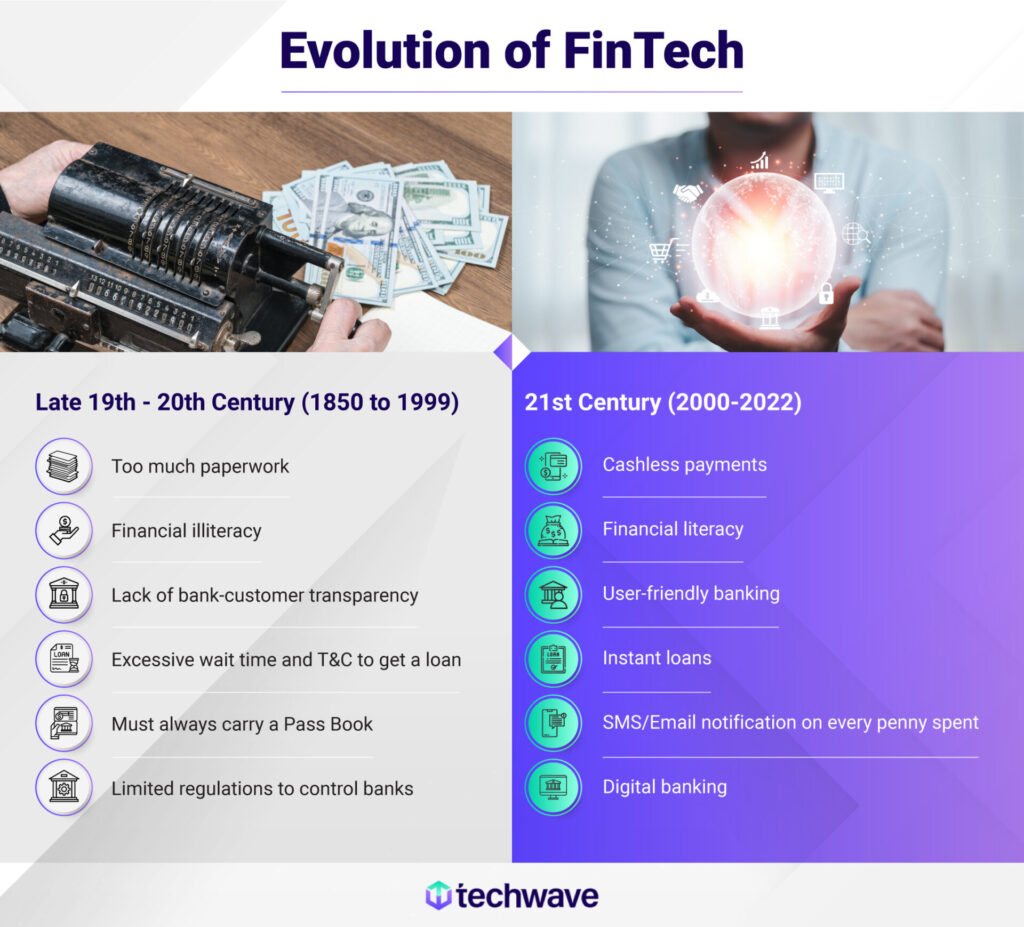

How was the future of finance shaped over the decades?

Most of us would like to believe that FinTech is a product of the modern era. However, Fintech is not a sudden emergence but something that evolved across distinct eras.

It all started in the 20th century with the launch of Fedwire in the USA (1918), the world’s first electronic fund transfer system. The 1950s saw the birth of credit cards to ease the burden of carrying cash everywhere. Then came the launch of the first ATM by Barclays Bank in 1967. This led to e-commerce and online banking development in the 1990s.

All of this came crashing down in the 21st century with the Global Financial Crisis in 2008. The era created a power vacuum, building a conducive environment for new FinTech startups and the new banking sectors to grow.

However, the most rapid and transformational change in FinTech happened in the last decade. Following is a glimpse of it:

1) 2011-2012: This period saw the rise of smartphones and mobile internet (2G/3G), getting distributed worldwide. Thus, leveling the field for FinTech to thrive.

2) 2013-2014: This period embarked on the journey to cashless payments. Mint and Paypal pioneered and dominated the e-payment market of the FinTech Industry.

3) 2014-2018: This period saw the growth of many subcategories of FinTech, such as RegTech, Instant Loans, BNPL application, etc.

4) 2018-2019: With growing regulatory norms, client transparency and finance literacy were advocated with Email notifications and SMS updates, amongst others.

5) 2020-Till Now: The world came to a halt during the pandemic. With digitalization now becoming a necessity, many novel concepts like Digital Bank, InsurTech and PropTech, crowdfunding, and Cloud Security have now become a reality.

In a recent interview, the CEO & Co-Founder of Techwave, Mr. Raj Gummadapu, assures that the future of finance is more customer-friendly, non-traditional, and overlapping. He described this by saying, “Fintechs are becoming a replacement for many proprietary legacy systems. More co-development and joint ventures are expected in multiple sectors and industries where there are some historical inefficiencies and expenses.”

Recent Technological Trends to Revolutionize the Future of Finance

As technology plays an ever-more-central role in the financial sector, banks and FinTech companies sometimes compete for the same market share. Thanks to this ecosystem of co-development and healthy competition, the industry has witnessed some amazing innovations, trends, and technologies spearheading the future of finance. Here are a few:

● Biometric Authentication The protection of bank accounts as an essential concern for 93% of consumers, making FinTech a priority sector for biometric authentication technology. Regular passwords and PINs are considered less secure than biometric authentication. In line with this, researchers have predicted that the global biometrics market will increase from $36.6 billion in 2020 to $68.6 billion in 2025.

● Buy Now Pay Later One of the most popular financial services developments in recent years is – Buy Now Pay Later (BNPL). With BNPL apps like Slice, Lazypay, and Uni pay, one may get their preferred chocolate cake in less than a minute without speaking to anyone, haggling, or waiting any longer than necessary.

● New investorsThe number of small investors grows worldwide each year, with North America showing the fastest growth rate over the last three years. Various FinTech applications such as Webull, Acorns, and Betterment are helping small investors avoid making significant financial commitments to stocks by letting them purchase shares in smaller dollar volumes.

● Digital BanksMany nations took a step toward the future of finance, for example, in India, when think-tank NITI Aayog presented a report on digital banks and outlined a strategy for licensing them. A digital bank does away with all paper-based transactions like demand drafts, pay-in slips, and checks by offering all of its services online, except making deposits.

● Instant loansThe demand for rapid online loans is rising in response to the ever-growing need for instant money for unanticipated needs such as weddings, travel, and medical emergencies. Instant loans are smaller-ticket size, short-term (9 months to 1 year) loans authorized the same day of the application without paperwork or a trip to the bank.

● Open Banking Often known as open API, it is about sharing bank client information with third parties, with the owner’s permission. The bank gives insurance providers, retailers, etc., details about the client’s financial situation. Before granting loans, insurance, or allowing installments, they confirm the client’s solvency. Therefore, making the granting process faster and streamlined.

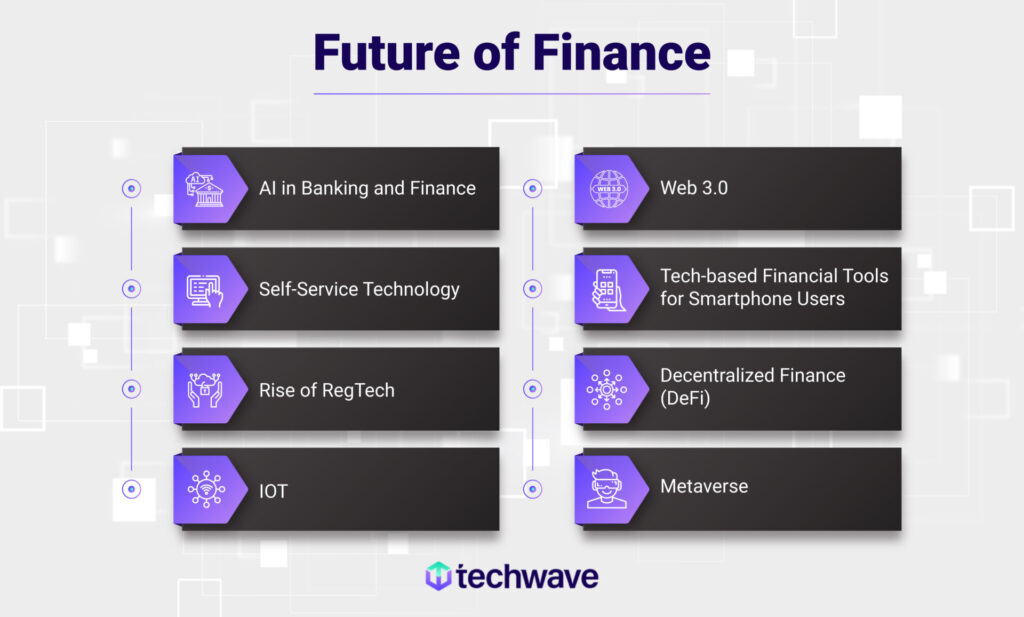

What does the future of finance behold?

The answer to this is best explained by this quote – “FinTechs can expect future technology breakthroughs to propel the expansion of the market even further and revolutionize the manufacturing, delivery, and consumption of financial products and services in the coming years.” – Raj Gummadapu, Co-founder & CEO, Techwave

Following are a few predictions you must expect:

1) AI in Banking and Finance: Blockchain and artificial intelligence-powered computers will increasingly collaborate with human workers, relieving them of repetitive tasks and providing them more freedom to be innovative and make judgments.

2) Self-service Technology: Smart agents, chatbots, Robo-advisors, etc., will do most of the problem-solving for the customer. Therefore, lowering dependency on customer service and banking agents.

3) Rise of RegTech: The future of financial services will get redefined by RegTech. The way risk management and regulatory compliance needs are addressed and delivered is evolving due to digitalization in banking. Collaboration amongst many actors, particularly between banks, regulators, RegTech companies, and consultants, is essential for this to happen.

4) IoT: The Internet of Things (IoT) has far-reaching implications for financial institutions. While IoT devices are frequently associated with consumer products, the advantages of having real-time data about clients’ physical assets are crucial to financial services firms looking to improve their current products and services, capitalize on customer purchasing behavior and create more personalized user experiences. Providing usage-based insurance and analyzing biometric data to enhance the credit underwriting process are two examples of common IoT uses in the financial services industry today. But a lot more will appear.

5) Web 3.0: The 3rd generation of web technology will enhance customers’ journey in FinTech. There will be faster, transparent, and more secure real-time transactions.

In the interview, Raj also discussed a few other upcoming trends that will disrupt FinTech. In his words –

- New smartphone-savvy users exploring tech-based financial tools for the first time can be signed up at a fraction of the costs based on their digital identities. FinTech startups are playing an essential role in both; bringing people to the financial mainstream and giving people methods and opportunities to improve financial well-being.

- With crypto adoption seeing growth, Decentralized Finance (DeFi) is expected to replace legacy systems such as ACH, SWIFT to cut down on fees and for real-time transactions.

- Metaverse is a collection of virtual space and objects enabled by blockchain, augmented reality (AR), virtual reality (VR), and Web 3.0 players. Metaverse is a parallel economic system poised to thrive on the growth of decentralized finance (Defi). The finance angle to metaverse is expected to be a construct of Web 3.0 building blocks and different interface elements called verses, including protocols, products, and services enabling complex financial interplay between fungible and non-fungible tokens (NFTs).

Despite the technological revolution brought by FinTech, the industry has some challenges and issues that threaten the future of finance.

Foreseeing Threats and Challenges That May Hamper The Future of Finance

The future of finance may look bleak without addressing these six critical obstacles in the FinTech industry.

Threats

Data Breach

Remember the First American Financial Corp data breach in 2019? A silly website design flaw exposed 885 Million+ financial and personal records related to real estate transactions. It might be challenging to trust financial institutions after such data breaches. Therefore, data breach contingencies must be in place beforehand.

Fraud

Online criminals use technology to run illegal operations like fraud, identity theft, and money laundering. To secure the banking experience for the customer, more resources must be allocated to cloud security and the RegTech sector.

Phishing

Phishing is a modern cybersecurity threat looming over FinTech. Phishing emails/SMS often have infected links or attachments that initiate malware attacks on the target’s system or redirect to fake webpages that harvest login credentials. Such threats may navigate the future of finance in the wrong direction. There is a huge gap in the market for technology that effectively tackles phishing, and FinTech services must take full advantage of this to create financial security apps.

Challenges:

Evergrowing & Evolving Customer Expectations

Almost every FinTech solutions company today is dealing with growing customer expectations. And it does not stop at that! The expectations are also evolving! For example, one in two consumers wants personalized banking advice based on their unique situation. They seek advice on how to manage money as well as an examination of their spending patterns. Both big and small players in the financial industry must consider such customer expectations to be at the top of their game.

Endless Regulations

The pressure on the FinTech industry to comply with existing and prospective rules and, more precisely, foresee what’s coming next and prepare months or years in advance is a challenge. It has intensified due to growing regulatory pressures and geopolitical tensions.

Blockchain Integration

many financial organizations still find it challenging to integrate blockchain technology. The problem is that many financial institutions and banks are still slowly picking up on the blockchain trend.

When dealing with the challenges, digital-first technology is the solution to improving customer experiences, as it is a significant element for business success in the future of finance.

Final Thoughts

Financial industries are highly susceptible to change, be it regulatory or technology. The future of finance will not have technology and risk regulations in silos. For FinTechs to scale up, risk management capability must be established from the very outset. This can help shape the business and enable safe and sustainable growth while enabling much better agility in responding to evolving market threats.

This approach also aids in recasting risk as an enabler of innovation. Thus, enabling FinTechs to collaborate closely with the product and engineering sectors and offer insightful data to guide product development

For instance, a FinTech company with sound risk management practices ingrained in its organizational design can include risk into its product and data models at an earlier stage. Thus, leveraging data analytics, AI, and ML along with other upcoming technologies with well-established IT services.

About Techwave

Techwave, as your IT partner, can help you navigate the future of finance by integrating your services with a broad range of technologies. These are not limited to digital processes, analytics, corporate resource planning, and the internet of things (IoT) but span upcoming trends and technologies like blockchain.

You can refer to our ‘Top 5 Blockchain Myths’ to understand the facts and myths related to the technology. Our FinTech Center of Excellence for Visa at the Techwave campus in Hyderabad, launched in December 2019, focuses on connecting the world through the Visa Direct real-time payment platform.

With many years of experience working with financial institutions, we have earned an enviable reputation as the go-to provider for progressive banks and financial services. Our customized systems aid FinTech via cloud computing, app development, and the use of Big Data to transform decision-making while being ISO 20022 compliant.